Community living comes with shared responsibilities, and finances are at the core of it all. One of the most essential processes in any strata, owners’ corporation, or body corporate is creating, approving, and managing the annual budget. This outlines how your shared money is intended to be spent, predicts future expenses, and sets the levies each owner must pay.

Whether you’re an owner, investor, or committee member, understanding how to read a strata budget is essential for maintaining your building’s financial health, avoiding shortfalls, and making informed decisions about maintenance and long-term projects.

A strata budget is a forecast of expenses required to manage and maintain a strata scheme or body corporate over a 12-month financial period. It forms the basis for levies collected from lot owners to cover shared expenses.

Every year, the owners corporation or body corporate must prepare a budget and present it at the Annual General Meeting (AGM) for approval by lot owners.

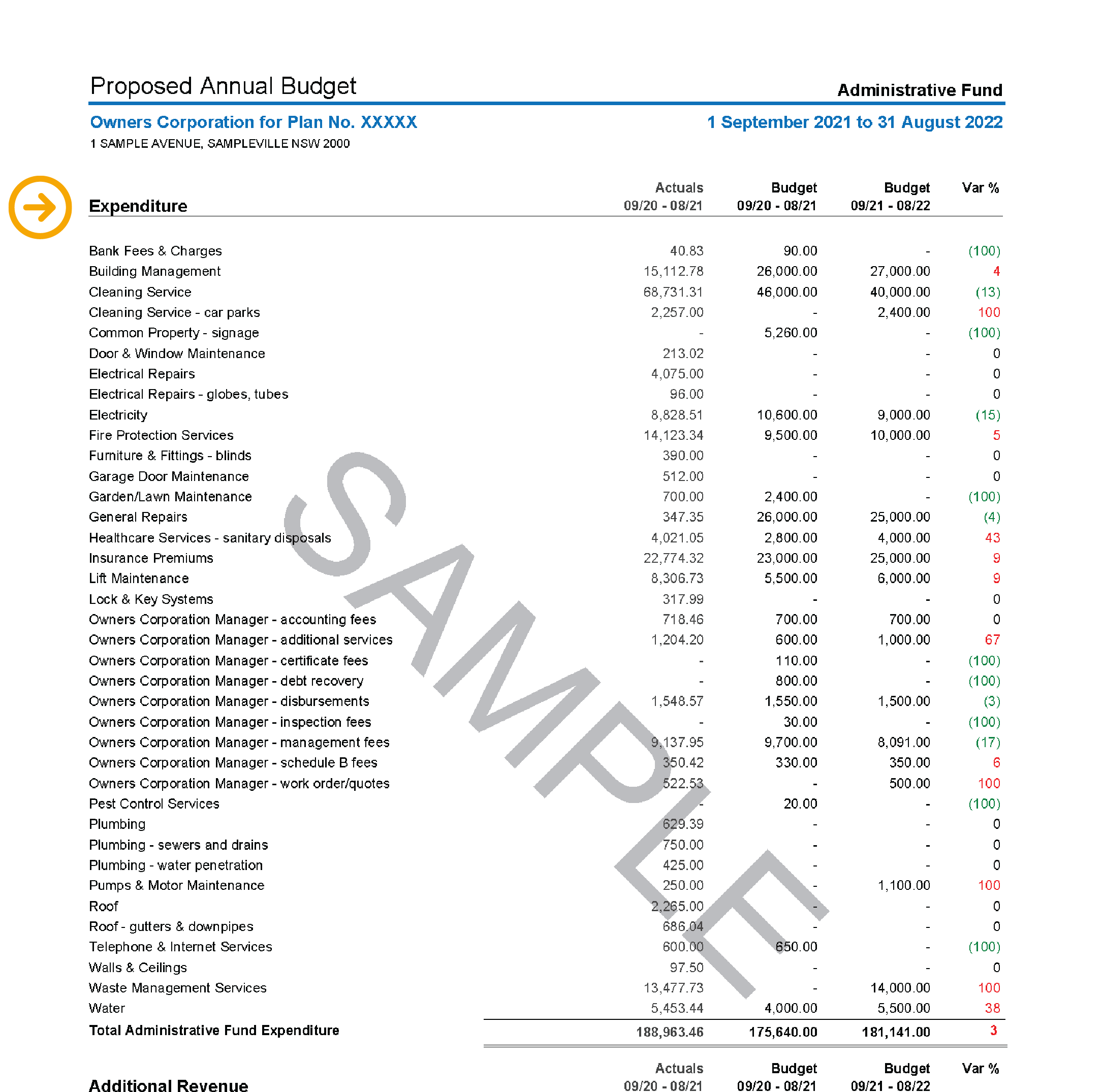

This section breaks down all reasonably expected costs, within account codes, for the coming financial year. These are used to group similar expenses, such as general repairs or lawn maintenance. The budgeted amount for each line item is based on the previous year's spending, as shown in this report.

This section includes any revenue the property may receive, not including levies issued to owners. Additional revenue may include bank interest on deposits, penalty interest on late payments, recoveries from owners for costs incurred (e.g. debt recovery), leases, or licence fees.

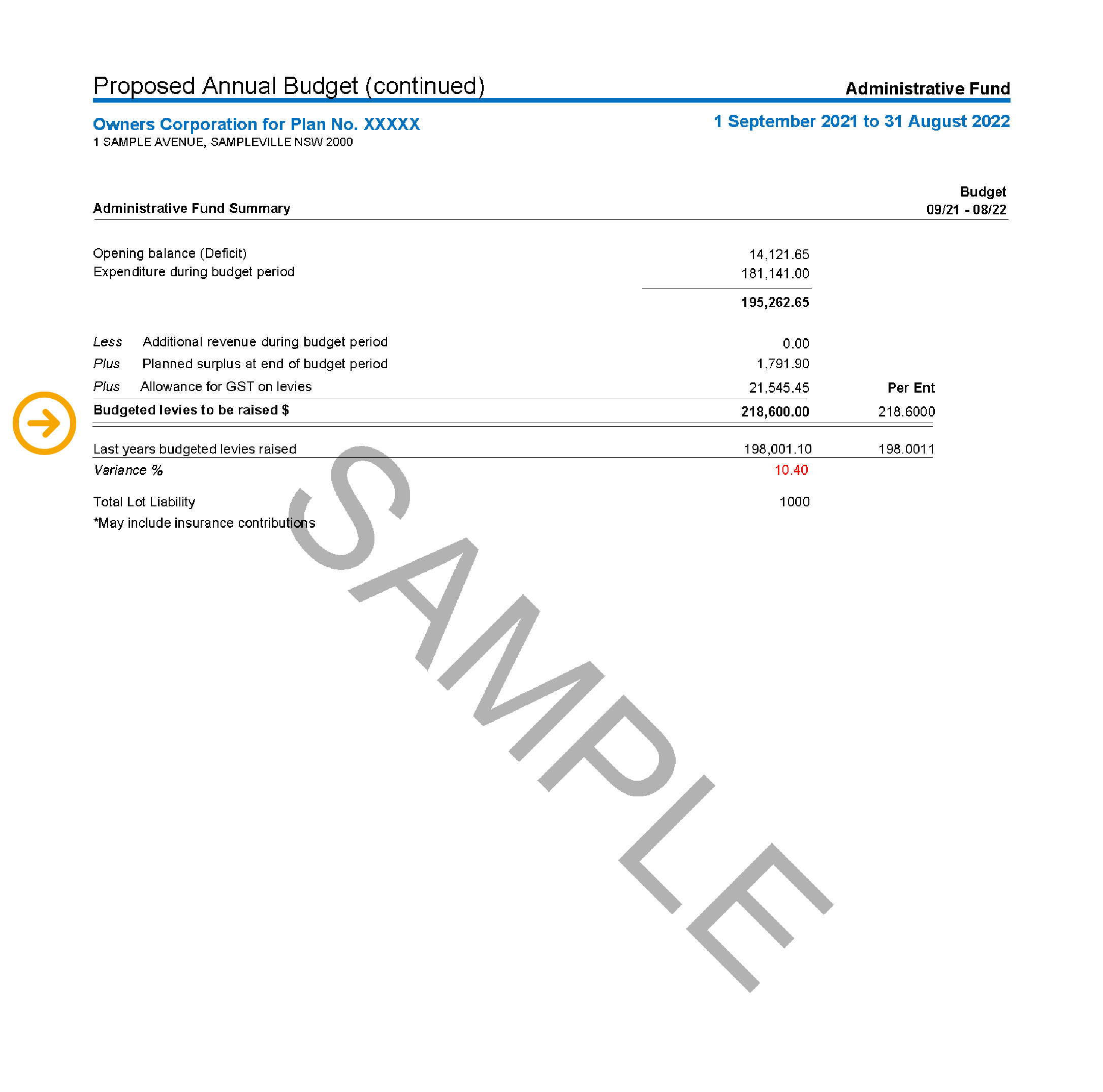

The levies proposed within the budget are the amount the owners are required to contribute to cover the owners’ corporation or body corporate expenses. Sometimes, where a contracted or guaranteed additional revenue stream is available, this fund may be used to reduce the amount required from owners.

A strata budget helps form the backbone of your building’s operations. It determines how well your property is maintained, how smoothly services run, and whether your scheme is financially prepared for the future. It’s a tool for transparency, planning, and protection, helping the owners’ corporation or body corporate avoid financial surprise and maintain the property’s long-term value.

A well-prepared budget helps:

Underfunded budgets often leave strata schemes unprepared for unexpected repairs, rising service costs, or essential upgrades. Without enough financial buffer, issues such as a broken lift or a leaking roof can quickly escalate into urgent problems. This may lead to delays, frustration among owners, or, in some cases, legal or safety risks. A budget that doesn’t reflect the true cost of maintaining the property could lead to:

This information explains how the building’s operations are funded. The main source of income is owner levies, which are regular contributions paid by lot owners. Relying on one-off income, such as special levies, to balance the budget, can be a red flag. These sources are unpredictable and should not be used to offset core expenses. Additional income may include:

The budget takes the scheme’s annual administrative fund expenses into consideration. It is best practice to compare each line item against last year’s actual expenses and explain any significant variations, such as an increase in electricity costs or new cleaning contracts. A typical budget includes:

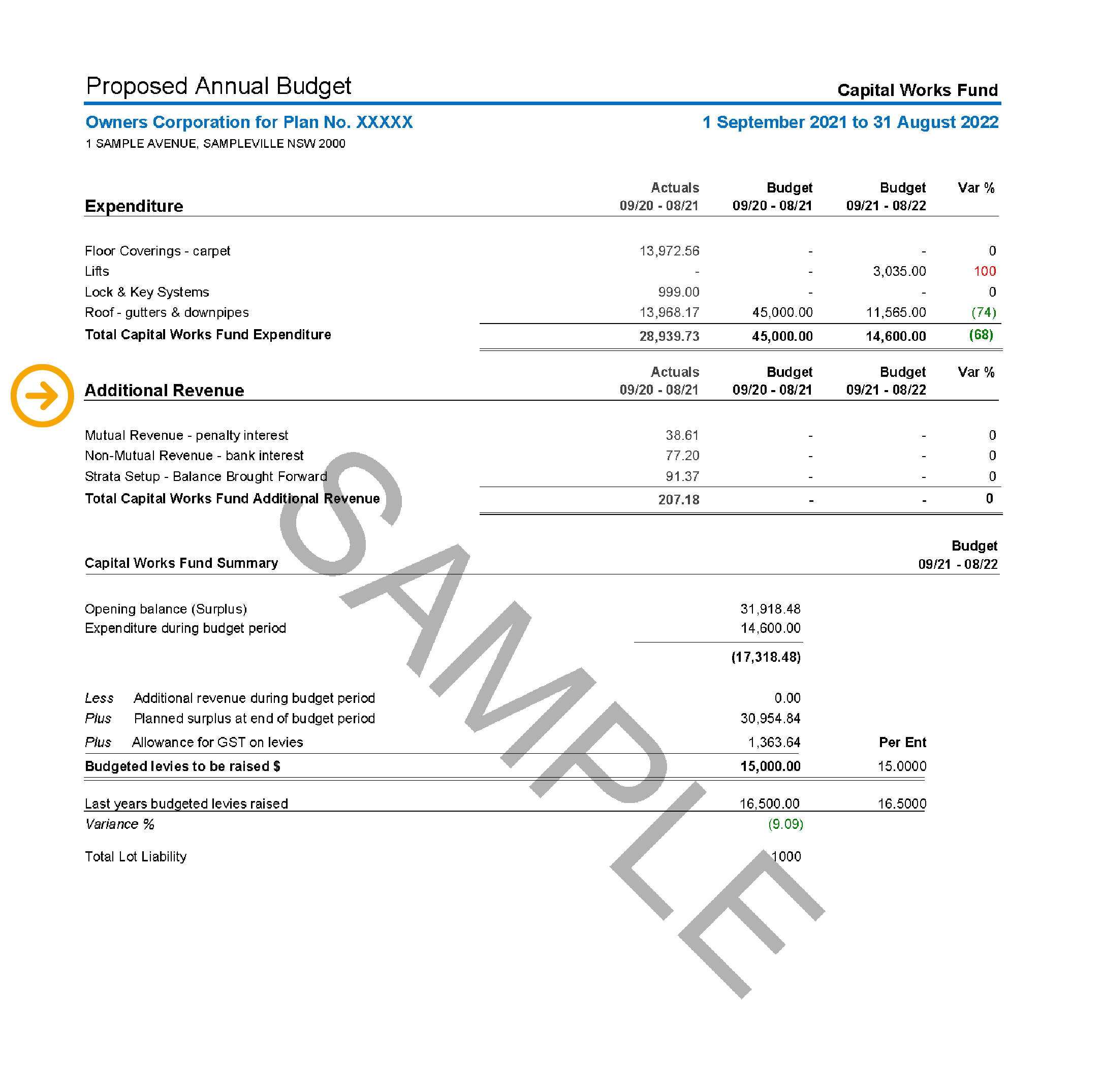

The budget should align with a capital works plan or sinking fund forecast, which projects maintenance costs over the next 10 – 15 years. This includes long-term projects such as:

A well-managed budget aims for a modest surplus to cover unexpected costs. This buffer can help absorb minor emergencies, seasonal variations in expenses, or delays in levy payments.

On the other hand, a deficit means the scheme is spending more than it collects, which could potentially place unnecessary financial pressure on owners when things go wrong. This can lead to cash-flow issues, delayed repairs, or the need for special levies to cover shortfalls. It may also signal underfunding key areas like insurance or capital works, which can pose risks to property value and resident safety.

The budget calculates and forecasts how much each lot must contribute to fund the budget. Levies are divided according to unit entitlements, which are set out in the strata plan and reflect each lot’s relative size or value. The budget should show:

Having the right information upfront is essential to creating a budget that’s accurate, transparent, and aligned with the needs of the scheme.

Before drafting the budget, gathering all relevant financial data, forecasts, and operational details is important. Doing so helps the budget reflect actual costs, anticipate future needs, and avoid surprises like special levies or cash-flow shortfalls. Here’s what should be reviewed and ready before budget preparation begins:

Your committee or the strata, owners’ corporation, or body corporate manager should start by reviewing last year’s financial records and gathering all necessary resources to prepare the new budget. This process includes analysing income and expenditure reports to identify:

Where possible, review past invoices or obtain estimated quotes to build realistic budget forecasts. This helps estimate the cost of routine services, such as:

If the capital works or sinking fund has minimal contributions, the building may struggle to cover major repairs such as waterproofing or lift replacement. When preparing the annual budget, review:

Good budgets allow a small surplus or contingency line for unexpected costs (e.g. storm damage and urgent plumbing). If certain expenses rise dramatically without commentary, ask for quotes or documentation to confirm why. It is best practice to have a margin (often 5 – 10%) for unexpected price increases or emergencies.

Budgeting is not just planning;, it’s also about transparency. Before presenting the budget to all owners, your strata, owners’ corporation, or body corporate manager should seek pre-approval from the committee. This helps maintain transparency and alignment with the committee’s expectations.

At the AGM, the committee or manager should:

Preparing a strata budget is more than just crunching numbers; it’s about planning for the year ahead, maintaining the building, and maintaining financial stability for all owners. While the committee provides oversight and decision-making, the strata, owners’ corporation, or body corporate manager can also provide expert support throughout the process.

These managers bring professional expertise, financial insight, and operational knowledge to help committees make informed decisions. Their role is to help simplify the process, help the owners’ corporation or body corporate maintain compliance, and provide the data and tools needed to build a realistic and sustainable budget.

Before renewing your agreement, take a moment to compare your options. Our quick and easy form can be completed in less than 30 seconds.

A strata budget isn’t just an accounting formality; it’s the roadmap for your building’s financial well-being. The more informed your committee is about budgeting principles, legal obligations, and long-term planning, the more confident and satisfied your community will be. Learning what goes into a budget can help owners and committees to make sound, transparent decisions about maintenance, levies, and long-term sustainability.

If you’re unsure about any aspect of your scheme’s finances, ask your strata, owners’ corporation, body corporate manager, or committee treasurer to walk you through the budget step-by-step.

This article is edited by Lauren Shaw Regional General Manager and Licensee-in-Charge on October 2025.