Each year, a few weeks before the annual general meeting (AGM), the owners corporation or body corporate will receive a range of financial reports. Each one is prepared for a specific purpose.

The documents consist of several elements combined to create a detailed overview of your property’s finances. This provides valuable information that may help you and your owners corporation or body corporate make informed decisions and meet the legal obligations regarding the property’s day-to-day requirements and long-term management.

This article is designed to help you understand the structure and purpose of your financial reports, covering key documents like the annual budget, monthly reconciliation reports, and levy notices. At the end of this guide, you’ll also find a glossary that explains many of the financial and strata industry terms you may encounter.

An annual financial report provides a snapshot of the property’s income and expenses over 12-months. It helps the owners corporation or body corporate gauge how their funds are collected and spent and how to budget for the year ahead.

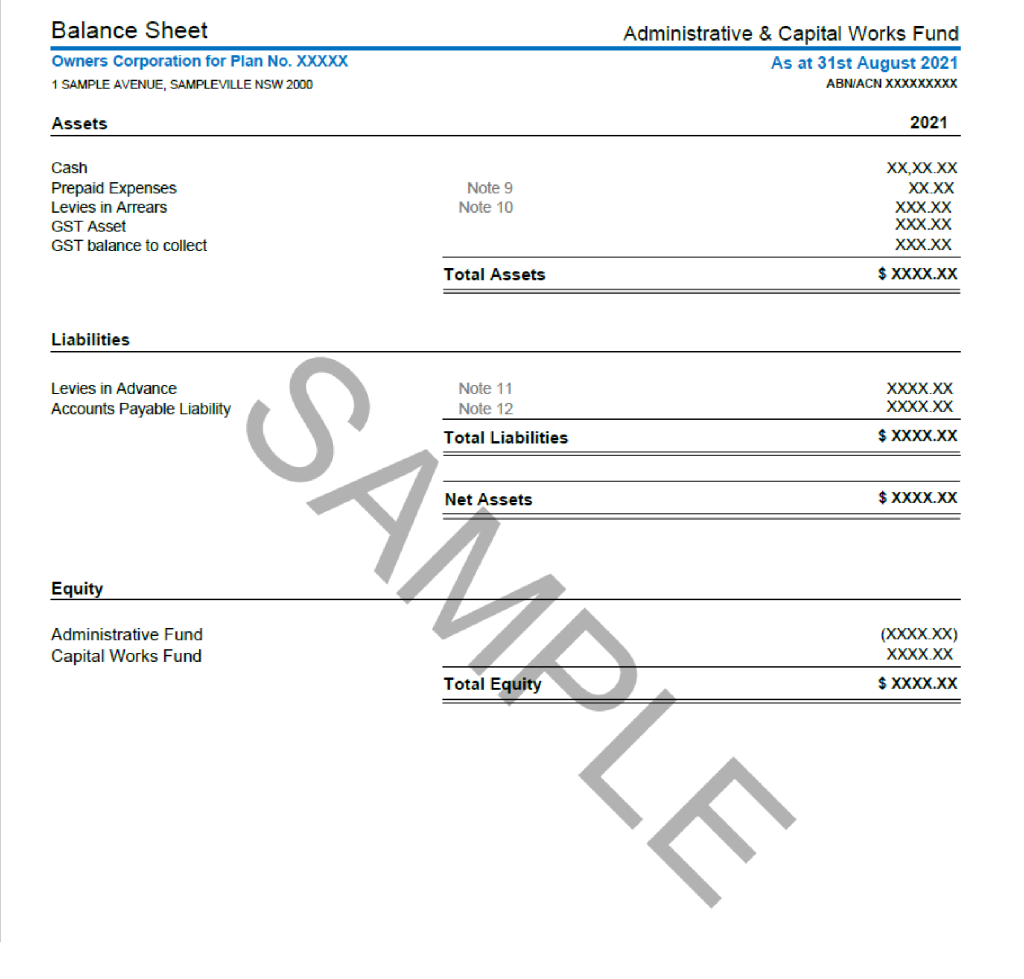

This document contains various sections to help understand your property’s financial position, such as the balance sheet, income statement, and notes for financial reports.

This document details the owners corporation’s assets, liabilities and capital. It specifies the balance of income and expenditure over the preceding financial year.

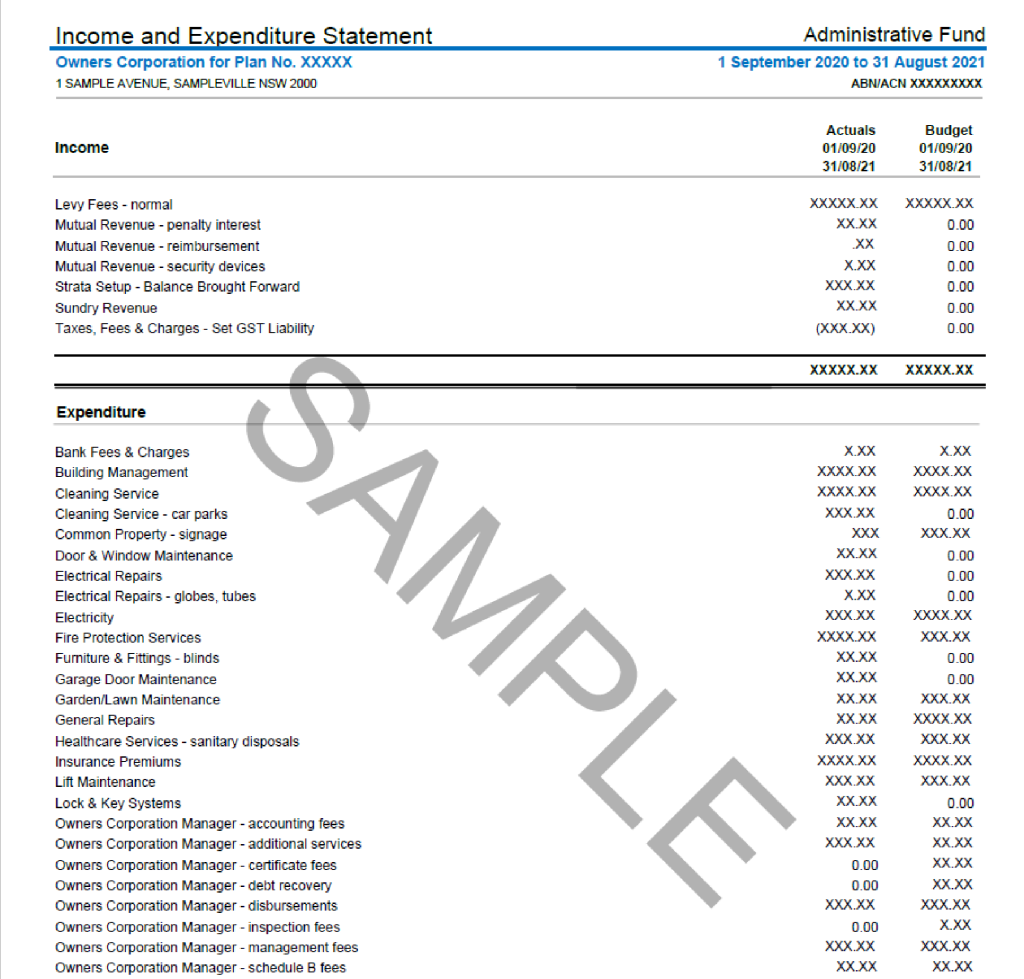

This section details all money received by the owners corporation or body corporate.

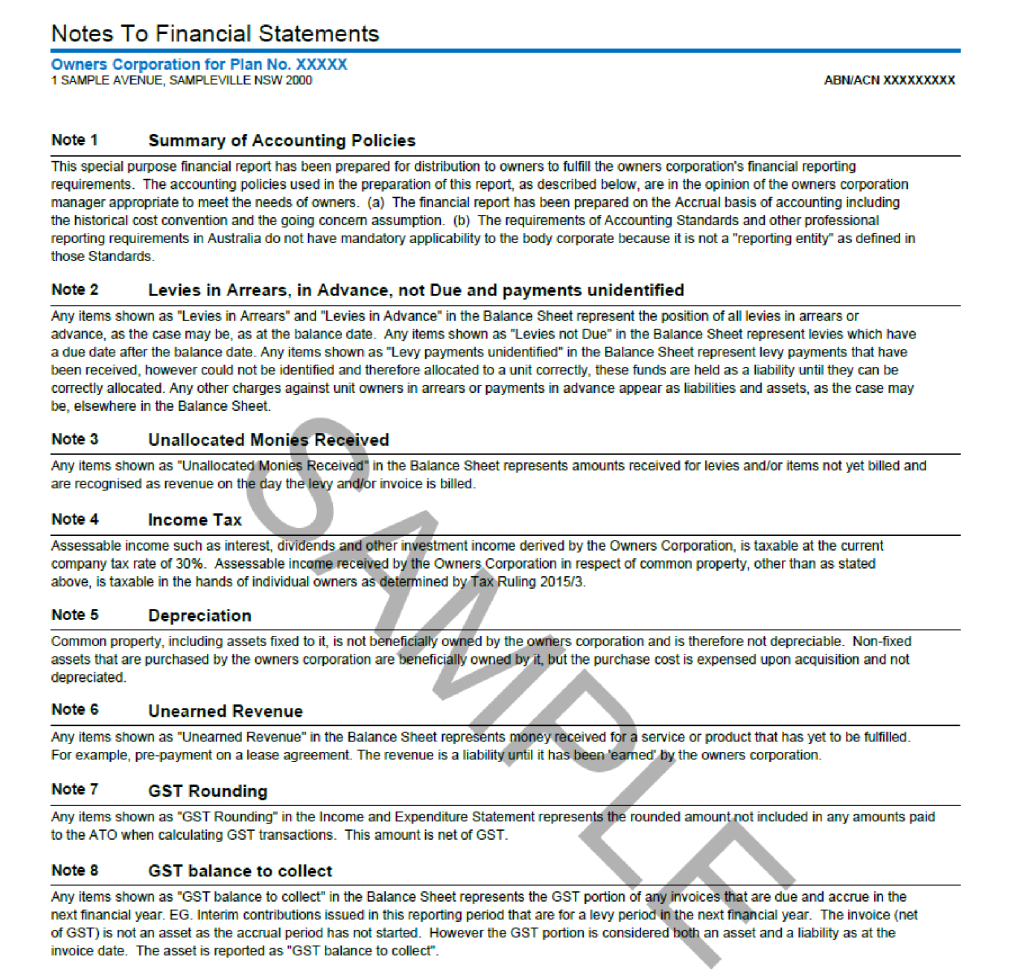

This section provides additional information on the financial statements that is left from the main reporting documents.

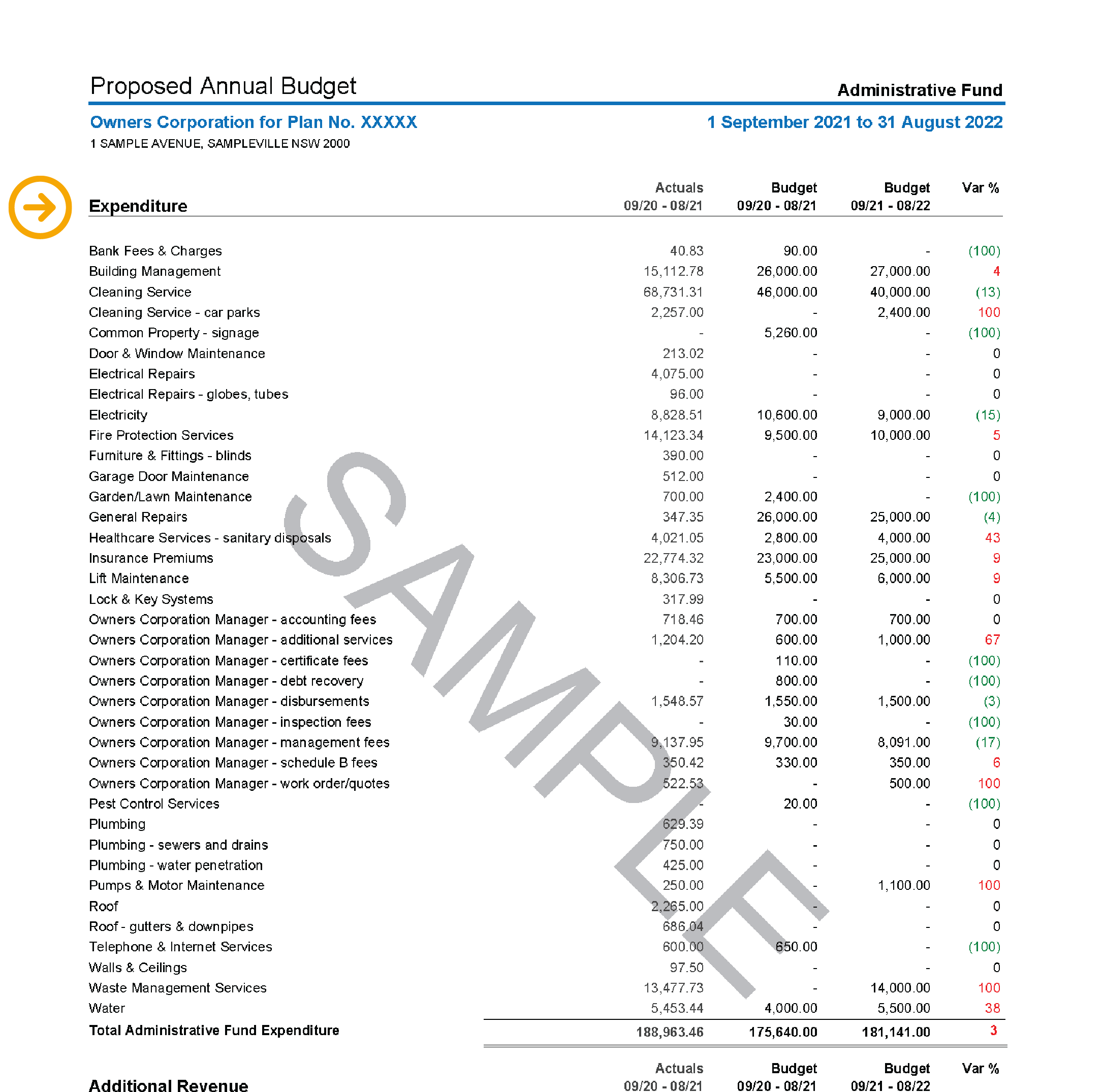

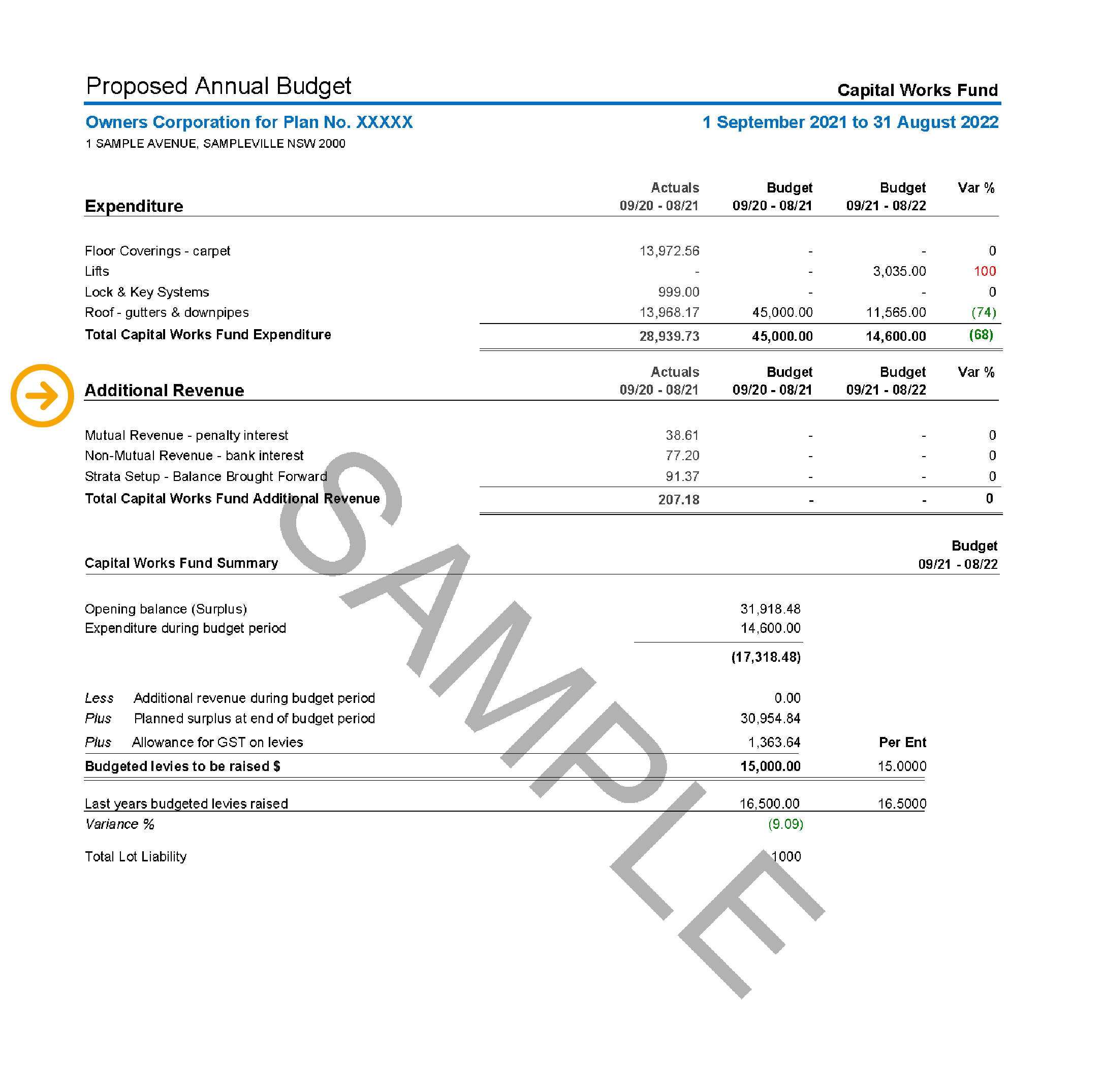

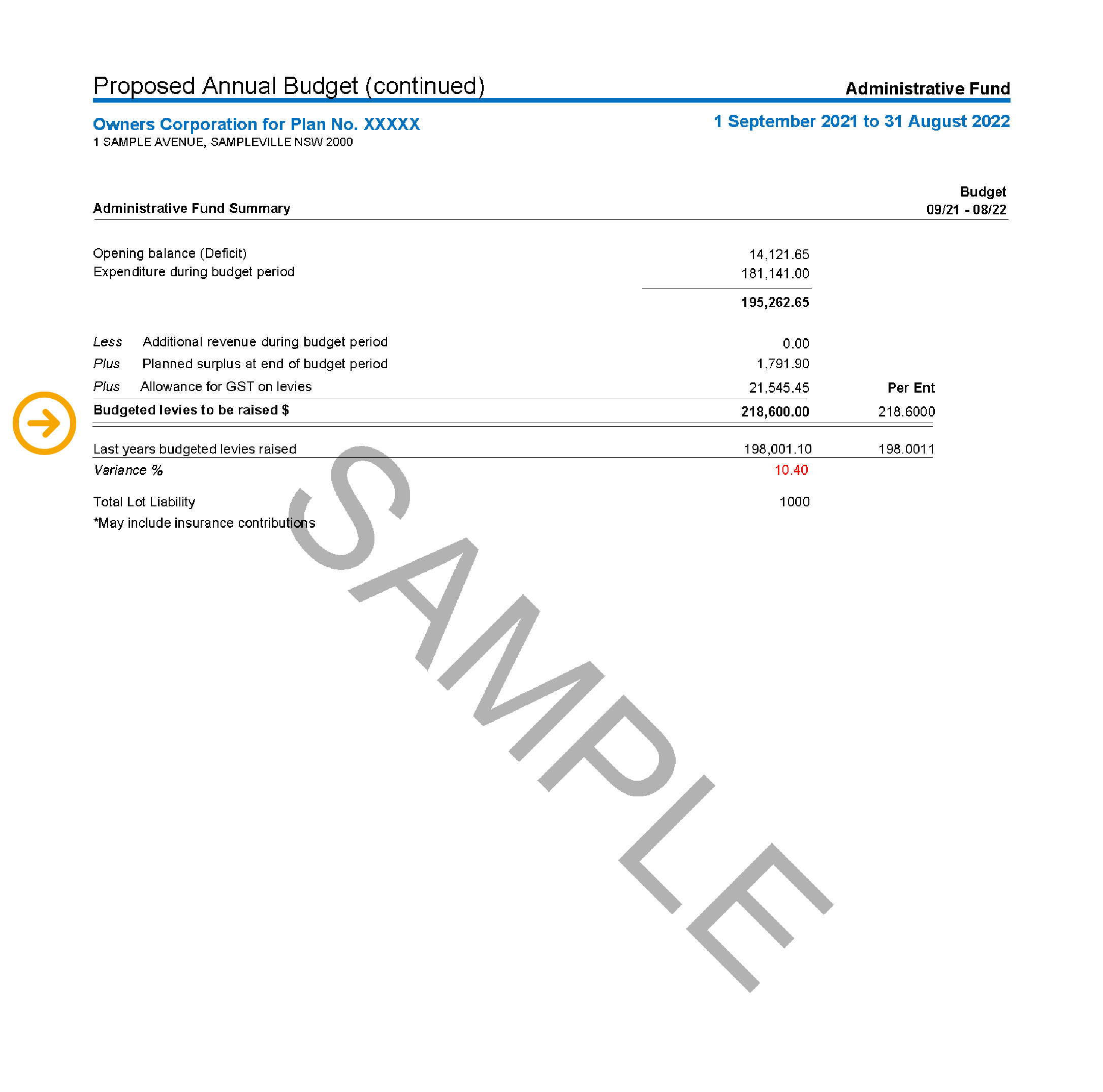

An annual budget outlines the income and expenses expected for the coming financial year. It is reviewed at the AGM, and once approved, it helps the owners corporation or body corporate make educated decisions on how to set the levies and spend funds for the next financial year.

This section breaks down all reasonably expected costs for the financial year ahead within account codes. These are used to group similar expenses, such as general repairs or lawn maintenance. The budgeted amount for each line item is based on the previous year’s spending, as shown in this report.

This section includes any revenue the property may receive, not including levies issued to owners. Additional revenue includes bank interest on deposits, penalty interest on late payments, recoveries from owners for costs incurred (e.g., debt recovery), leases or licence fees.

The levies proposed within the budget will be the amount the owners are required to contribute to cover the owners corporation or body corporate expenses. Sometimes, where a contracted or guaranteed additional revenue stream is available, this fund may be used to reduce the amount required to be raised from owners.

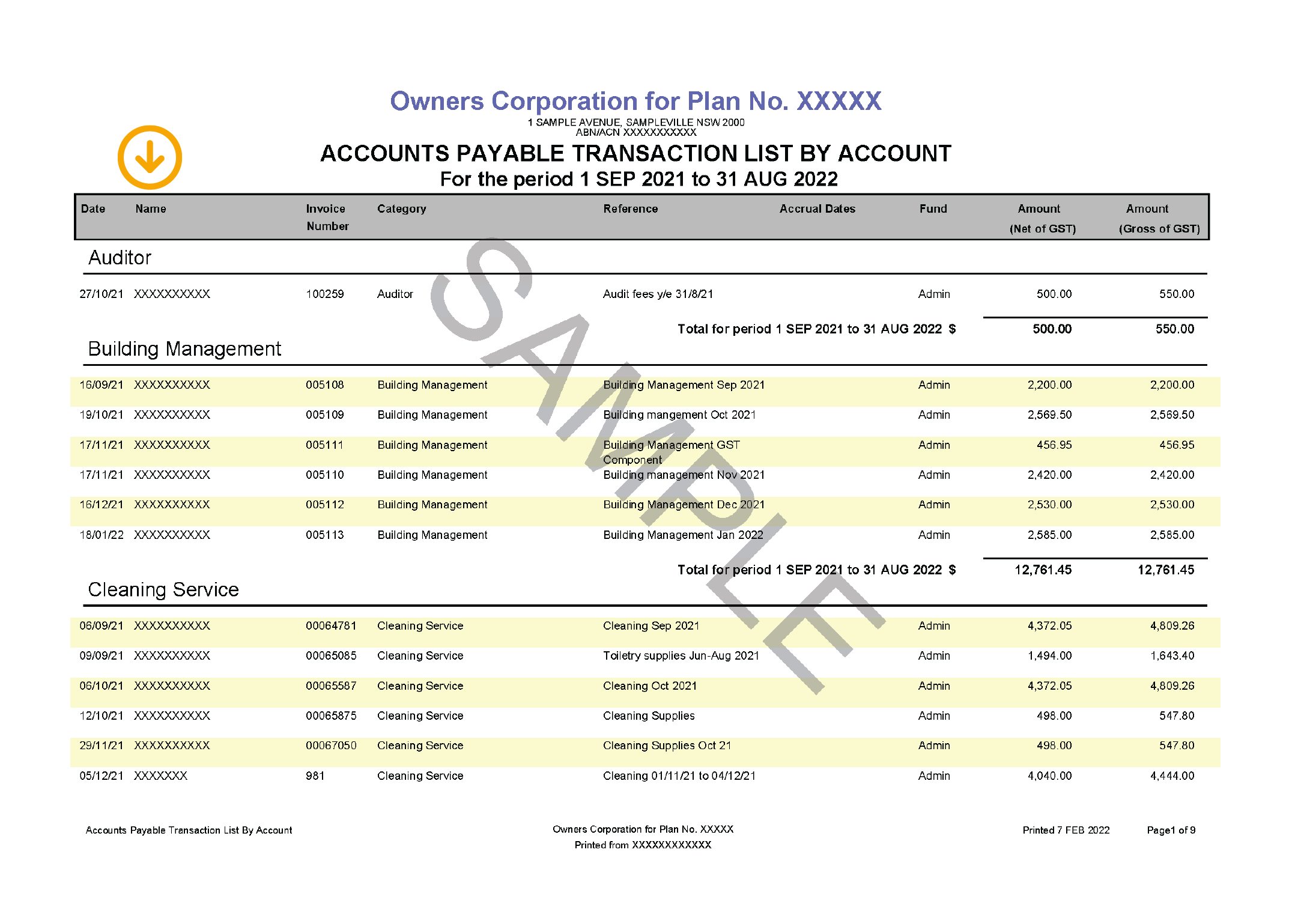

An accounts payable ledger is a statement of all transactions paid over a specified period. The treasurer typically uses this document.

Name of the supplier, business or contractor the owners corporation or body corporate has paid.

This section outlines the category of service the supplier provides, such as cleaning or gardening.

An accounts payable ledger is a statement of all transactions paid over a specified period. The treasurer typically uses this document.

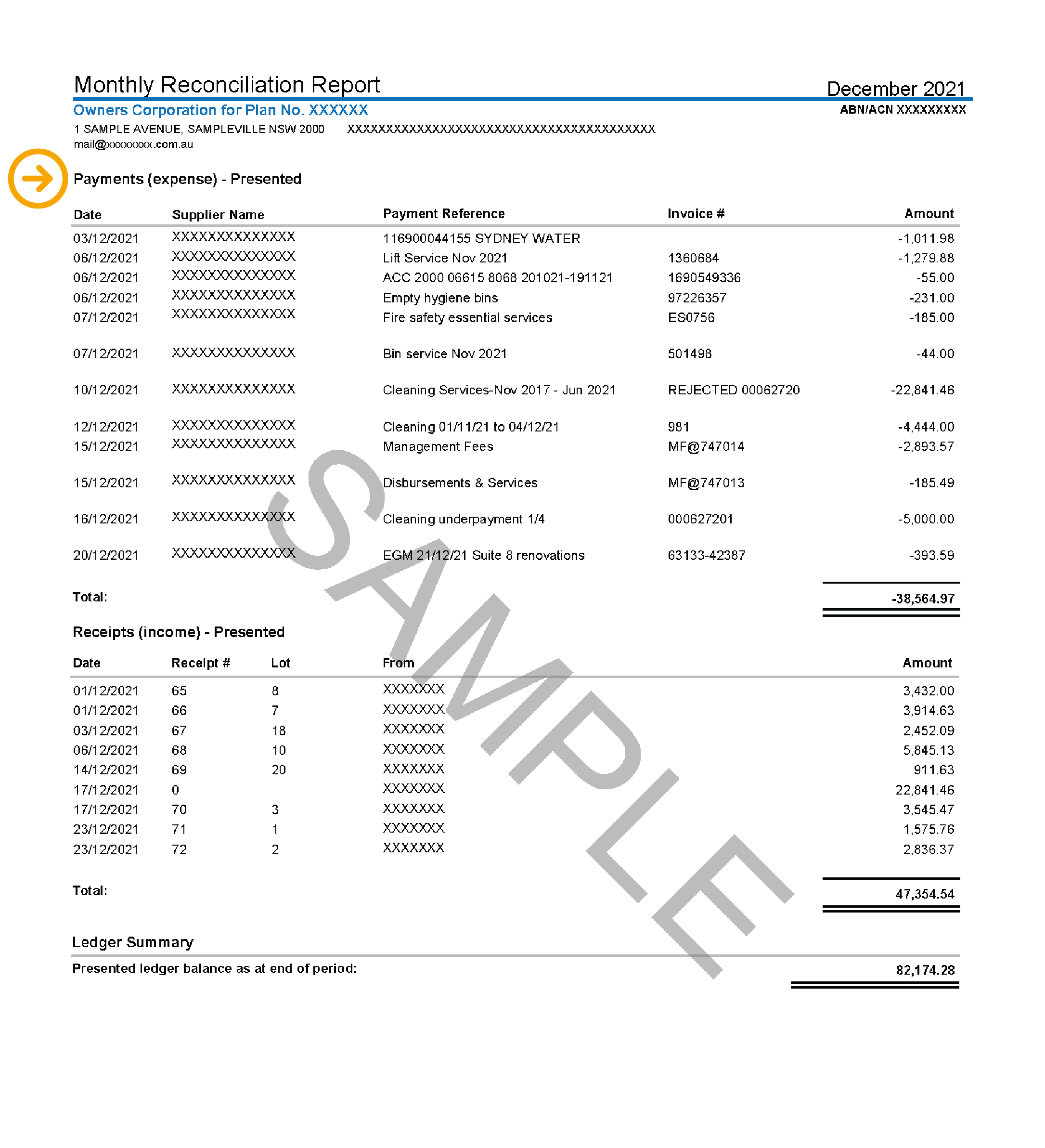

All payments made during the month, such as supplier payments.

Identifies the source of income, such as levy payments. In this section levy payments will include the lot number and amount.

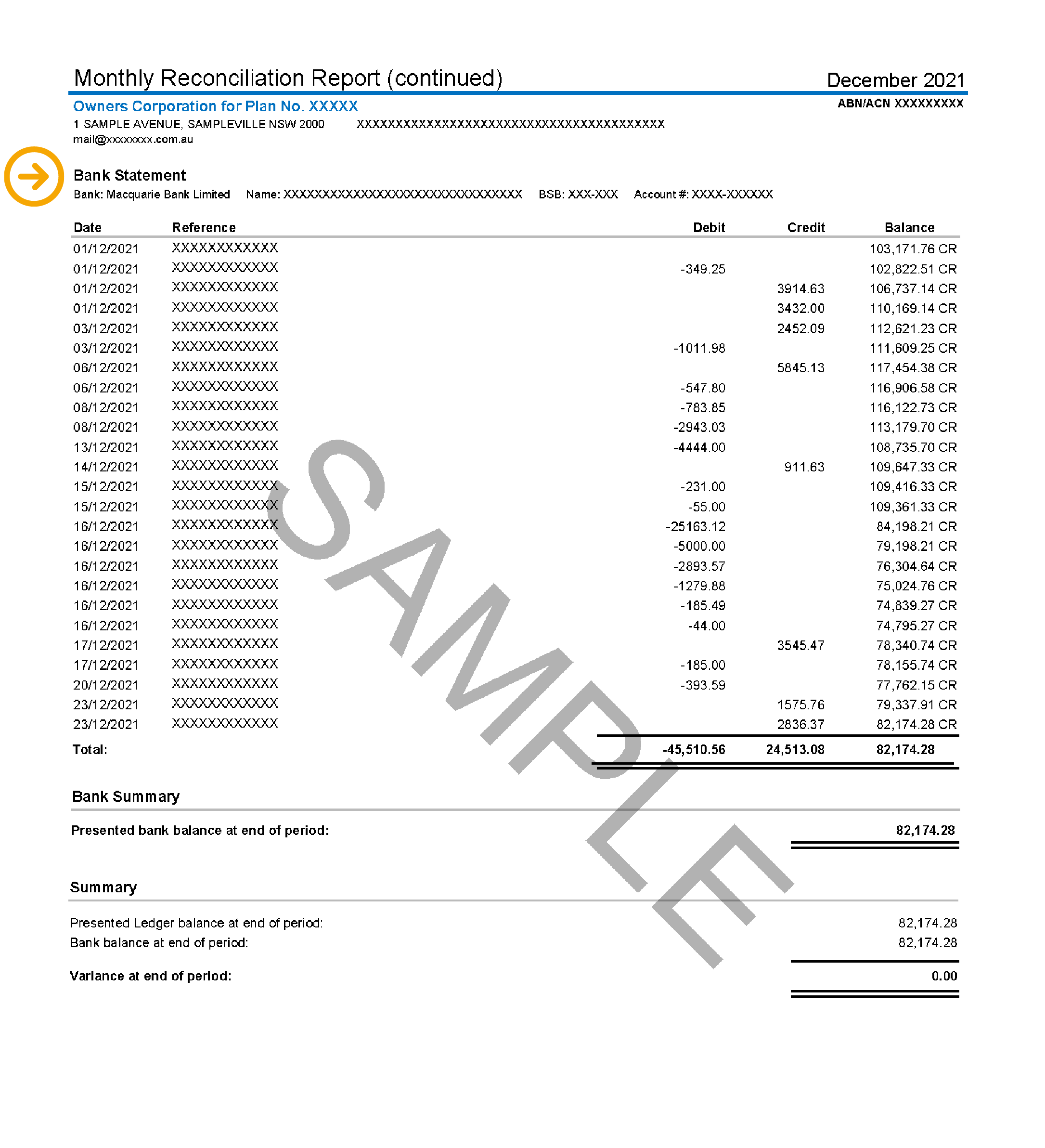

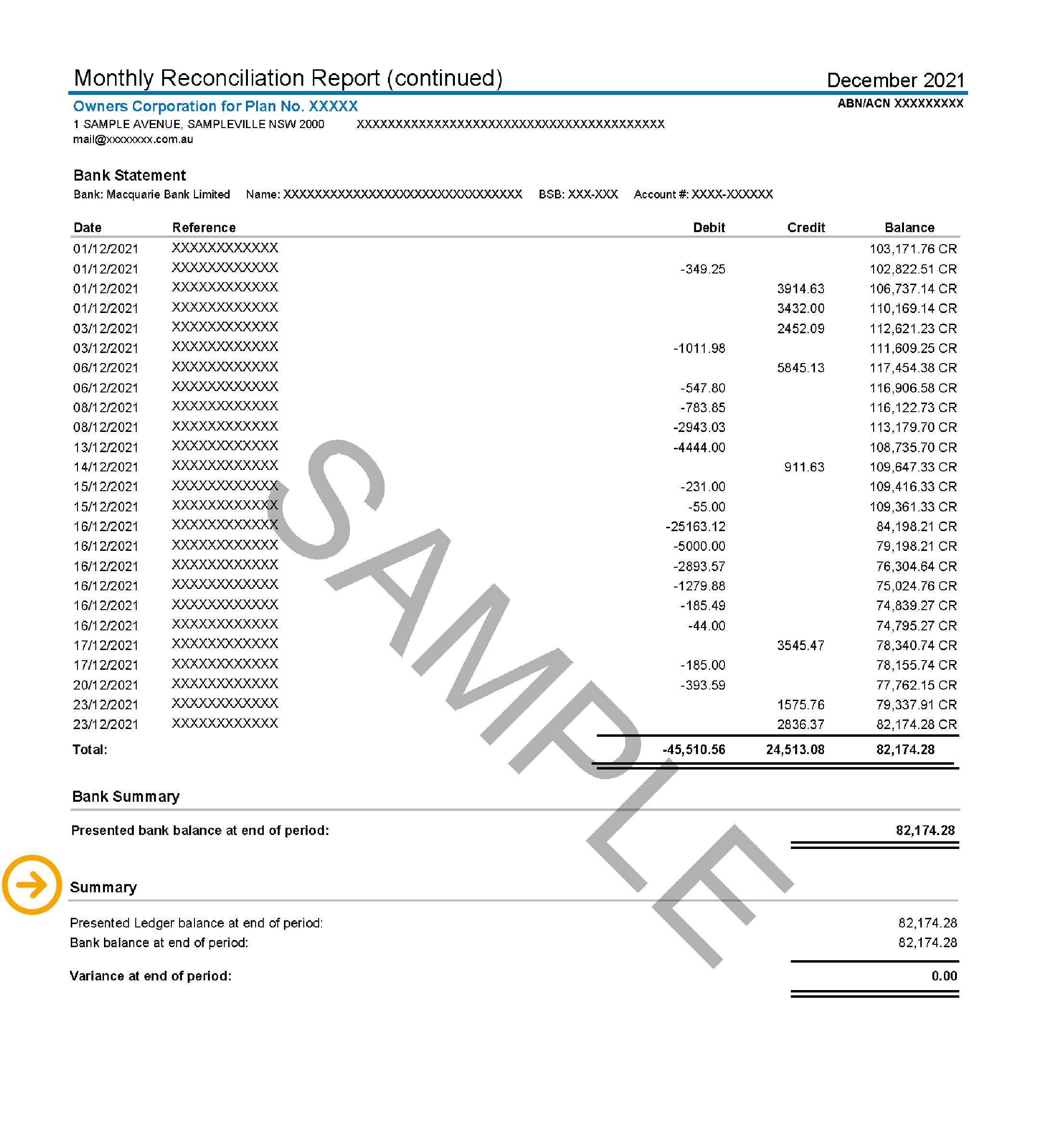

View each transaction (debits or outgoings and credits or incoming) in order, along with the original references.

Cash in bank figure at the end of the period.

Details the presented ledger balance and the bank balance at the end of the period. Any variance will be shown.

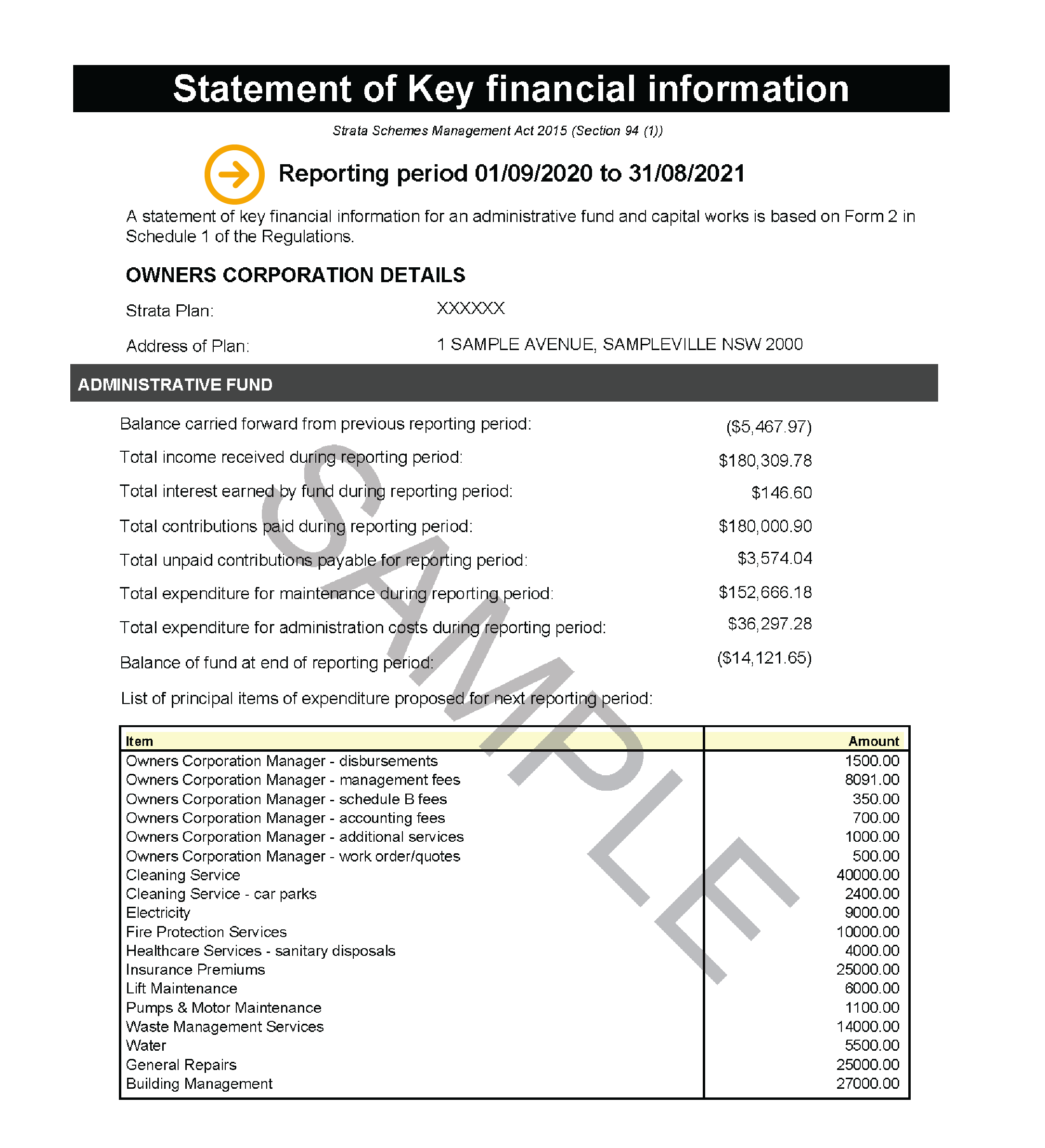

The statement of key financial information or income and expenditure transaction lists summarises the administrative and capital works or sinking funds and helps the owners corporation or body corporate decide if it needs to raise levies to meet its maintenance plans. It provides key information on the property’s financial position, transactions, and balance from the beginning to the end of the year.

This section outlines the time period that this financial report covers.

This overview provides a high-level summary of the administrative fund’s income and expenditure during the reporting period.

An itemised summary of all of the administration fund’s expenses during the reporting period.

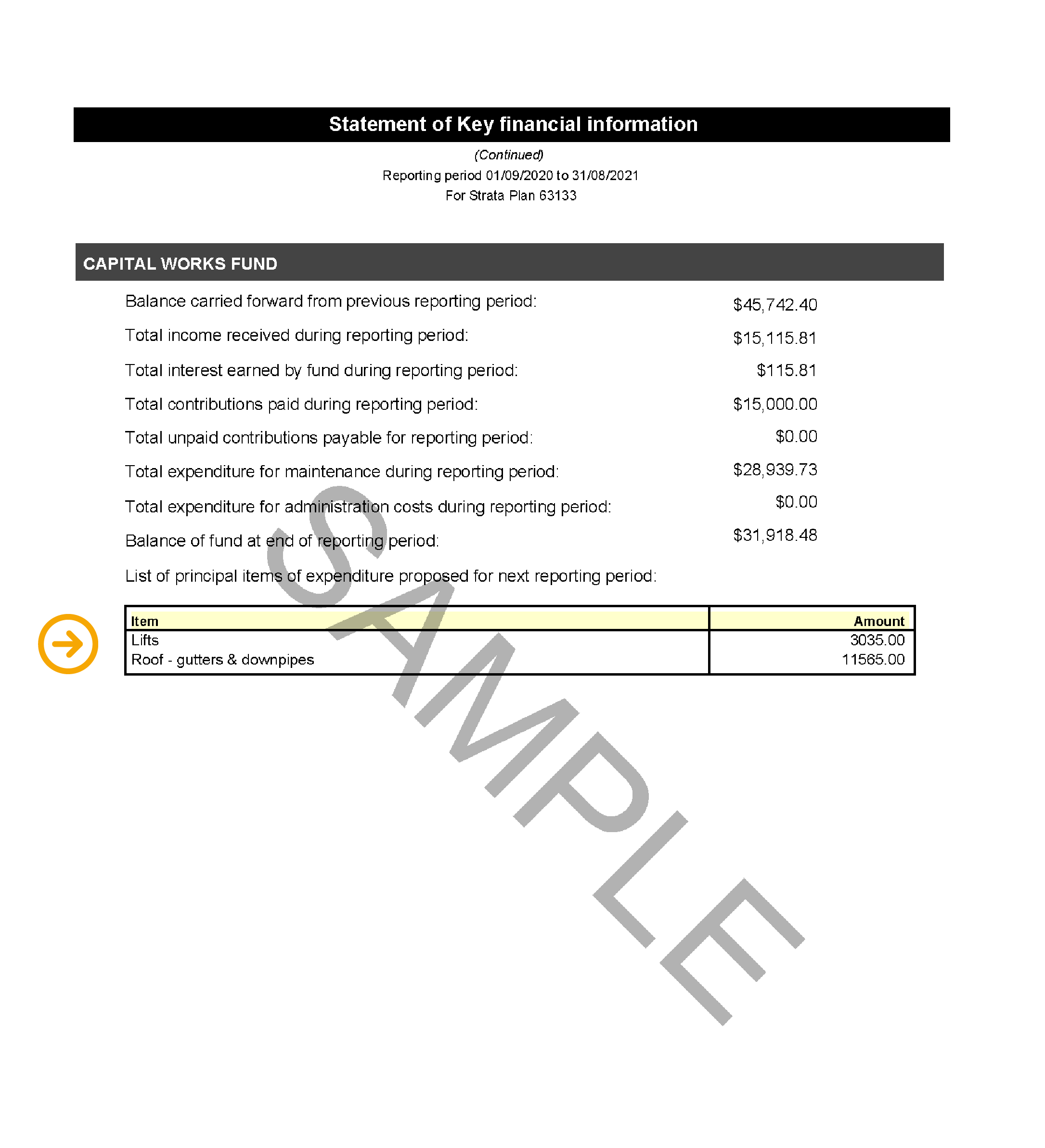

Provides a high-level summary of the capital works or sinking fund income and expenditure during the reporting period.

An itemised summary of all of the capital works/sinking fund expenses during the reporting period. View report layout

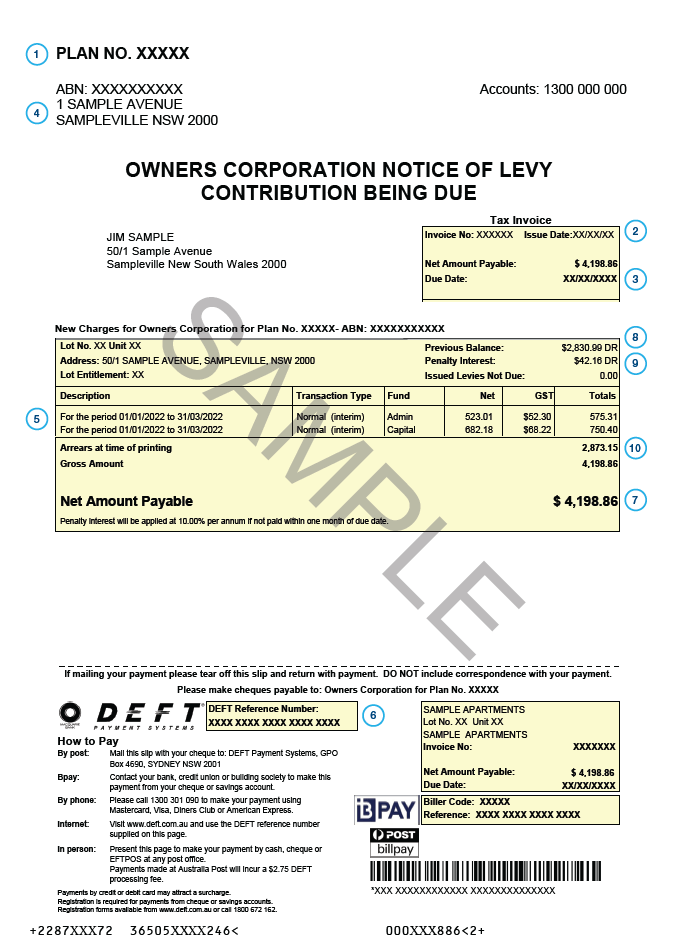

A levy notice is issued on behalf of the owners corporation or body corporate. It outlines the amount owed by each owner to contribute towards the operation and maintenance of the property, which is generated before the due date and is sent to each lot owner.

Plan number

Issue date

Due date

Strata scheme/body corporate/owners corporation address

Levy period

DEFT reference number

Total amount payable.

Previous balance – balance brought forward.

Penalty Interest.

Arrears at the time of printing = previous balance + penalty interest.

Before renewing your agreement, take a moment to compare your options. Our quick and easy form can be completed in less than 30 seconds.

This fund holds money that is set aside for day-to-day recurrent operating costs for your property. It may include some maintenance items if they are regular, routine and recurrent, such as a lift maintenance contract and fire and essential services inspections.

These are prepared for your property’s 12-month financial year.

They include the balance sheet, income statement, notes to the financials, and key financial information statements.

These items are owned by the owners corporation or body corporate, such as cash in the bank, money owed by lot owners for unpaid fees, or money due to be received from an insurance settlement. Generally, physical assets such as furniture, furnishings, buildings, and equipment are written off in the year they are purchased and do not depreciate over time. Therefore, they are not recorded as assets on the balance sheet.

This is an account where the owners corporation or body corporate funds are stored to allow payment of expenses and receive levy payments from lot owners.

This details what the owners corporation or body corporate owns (assets), what it owes (liabilities) and what lot owners are entitled to if the property is dissolved (equity).

If there is a positive balance when the liabilities are subtracted from the assets, this extra money is held in this fund. This surplus is what each lot owner is entitled to if the strata property is dissolved.

A capital works, sinking, or maintenance fund is a pool of money the owners corporation or body corporate sets aside for the future maintenance of the property. All owners contribute to this fund with each levy paid.

A deficit will occur when expenses paid are greater than income received. If there are recurring deficits, the strata levies will need to be increased or expenses reduced.

These are costs incurred by the owners corporation or body corporate. Examples include insurance premiums, utility bills, council charges, compliance fees (fire safety, ventilation systems, access, etc.), caretaker or building manager fees, and strata management fees.

This is not the Australian financial year from 1 July to 30 June. Your strata property’s financial year is the agreed annual period to which the owners corporation or body corporate prepares and manages finances. It may be different from property to property.

This is the money the owners corporation or body corporate receives. It consists of strata levies paid by owners, interest accrued (either bank or penalty interest for late payment), reimbursed money, and lease or license income

This can also be referred to as the profit and loss statement. This statement is always prepared for a period of time (e.g. 12 months) and reports the transactions during that period only. It comprises two elements: income and expenses. Combining the two elements will result in a surplus or a deficit for the reporting period.

These are issued if an insurance premium is not paid in the same proportion as the annual budget. Instead, when the scheme was created, it was determined to be more equitably split differently.

These are prepared temporarily, for a week, fortnight, month, quarter, half-year or some other period than an annual (12 months). They are often used to gain insights when making important decisions and reviewing the strata property’s annual budget adoption.

This is where surplus funds, or funds that won’t be used in the short term can be stored to generate interest income. This may be at-call, meaning funds can be accessed immediately, or a term deposit account where the funds are locked in for an agreed period.

These are what the owners corporation or body corproate owes. Examples include unpaid invoices to creditors and money paid in advance by lot owners. If the owners corporation or body corporate has taken out a loan, the amount owing will be shown under liabilities.

This is money that a lot owner has paid before the due date. They can reclaim it until the due date and are therefore recognised as a liability until the due date.

This explains the accounting concepts and principles for preparing the annual financial report. It also contains details about items summarised in the balance sheet.

These names are used interchangeably to identify the body that owns and administers a strata property and can differ per state.

This report summarises the annual financial report, identifying a body corporate or owners corporation’s total income and expenses in one financial year.

A surplus will occur when the income received exceeds the expenses paid. This may be referred to as a profit. However, it is not distributed in the way a profit is, so it is more accurate to call it a surplus.

This calculates the proportion of levies, voting rights and interests in common property each lot has.

To learn more about managing your strata property’s financials, download our FREE Community Living guide here. We also provide our customers with an intuitive, modern, easy-to-use dashboard and 24/7 access to their financials and related information via CommunityHub. Or, to find out more about the services we offer, click here for a free strata assessment.

This article is edited by Lauren Shaw Regional General Manager and Licensee-in-Charge on February 2025.

Head office

Level 27, 66-68 Goulburn Street, Sydney, NSW 2000

Monday - Friday, 8:30 am - 5:00 pm