This information is provided on behalf of the owners corporation or body corporate with changes to the payment options Macquarie Bank offers.

If you don’t do anything, your direct debits will stop, and you’ll need to manually pay your levies from 1 July 2025. As this payment type is connected to your personal banking, unfortunately, we can’t action this for you.

Remember that any delay in paying your levies may be subject to arrears and debt collection procedures.

Due to the increased risk of fraud and scams, Macquarie Bank (a strata banking specialist) will no longer process traditional direct debits. Going forward, they will only process biller-initiated direct debit payments set up via the DEFT website. This change is crucial to ensuring the security of your payments.

On 30 June 2025, Macquarie Bank will stop traditional direct debit payments. This means your current direct debit arrangements will become inactive. If you don’t do anything, your direct debits will end, and you’ll need to manually pay your levies from 1 July 2025.

Owners who want a direct debit option need to set up a biller-initiated direct debit within DEFT.

To set up a biller-initiated direct debit via DEFT, please follow these simple steps:

Watch this video from Macquarie Bank on setting up a biller-initiated direct debit.

If you don’t follow all steps detailed above, your biller-initiated direct debit will not be set up and your account is at risk of arrears.

Once set up, we’ll deduct payments when due. You can also cancel direct debits anytime via the ‘DEFT reference numbers’ screen in your DEFT profile.

Please see your levy notice for other payment methods if you decide not to transition to biller-initiated direct debit. Should you choose to make another payment type like BPAY, please contact us to cancel your existing direct debit.

Welcome to our FAQ guide, designed to equip you with insightful knowledge and answer your most pressing questions. We hope this guide serves as an invaluable resource. So, let’s demystify any uncertainties you may have, as we believe in promoting transparency and fostering an informed community.

Biller-initiated direct debit is a DEFT payment system managed by Macquarie Bank. It is a payment method that takes the specific amount of your levy from your account on the due date. This is not a one-time permission and is valid even if the levy amount changes.

It’s important to be aware that if there aren’t enough funds in your account on the due date, your account could go into arrears.

This change only applies to your existing direct debit arrangements for levy payments. You can still pay through other methods as usual, such as by BPAY, Australia Post, or directly through DEFT.com.au.

Here is what you need to know if you have an existing direct debit:

This change applies to any direct debits you currently have for the property, regardless of the bank you’re with.

If you would like to continue using direct debits after 30 June 2025, you need to register for biller-initiated direct debits through DEFT.com.au. To set up biller-initiated direct debits, follow the steps under the ‘How to register for biller-initiated direct debits’ in the next section.

To set up biller-initiated direct debit, you will need to know the property’s unique DEFT reference number. You can learn more about how to find this number in the following section. If you have already registered with DEFT, you can follow the steps below to set up biller-initiated direct debits:

Visit deft.com.au and register or sign in to your account.

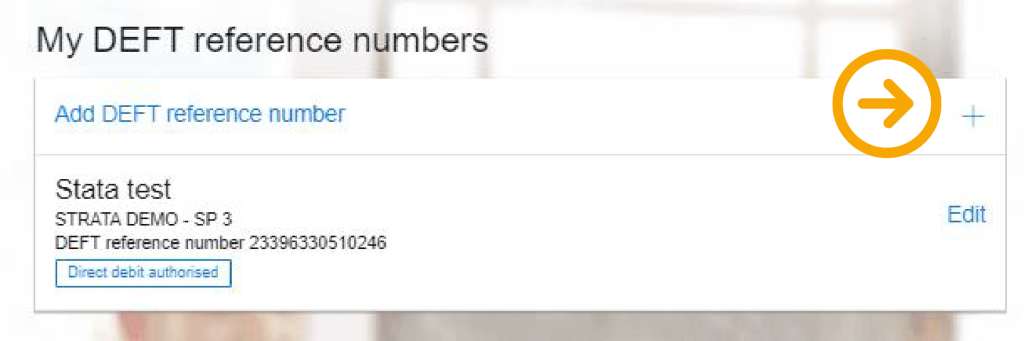

Go to 'DEFT reference numbers' and locate the DEFT reference number for the property for which you wish to set biller-initiated direct debits.

Click 'Add DEFT reference number' and follow the prompts to register the property that you wish to authorise direct debits for.

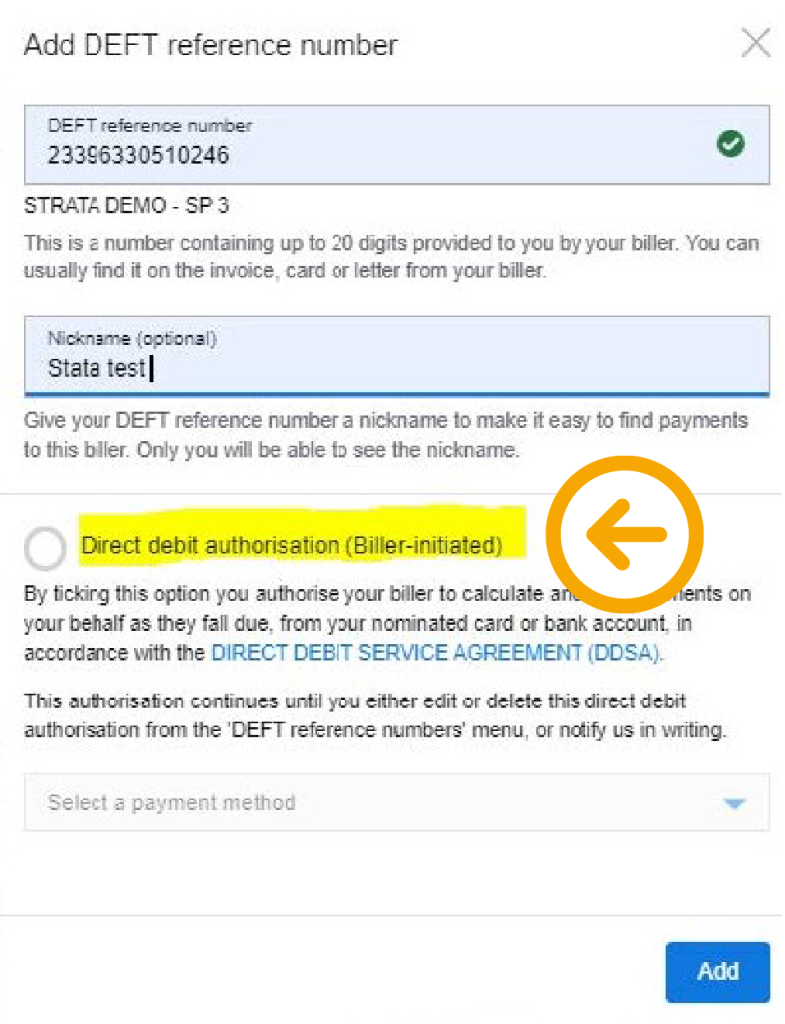

Tick' Direct debit authorisation (Biller-initiated)' circle, select a payment method and click 'Add' to finish setting up your biller-initiated direct debit payment.

Visit deft.com.au and register or sign in to your account.

Check that you've cancelled any outstanding active schedules on the DEFT reference number for the property that you wish to set biller-initiated direct debits by going to 'Schedule payments', then Selecting 'Edit' and selecting 'Delete'. Note: If you don't cancel any outstanding active schedules, a warning will pop up when you try to add DEFT biller-initiated direct debit.

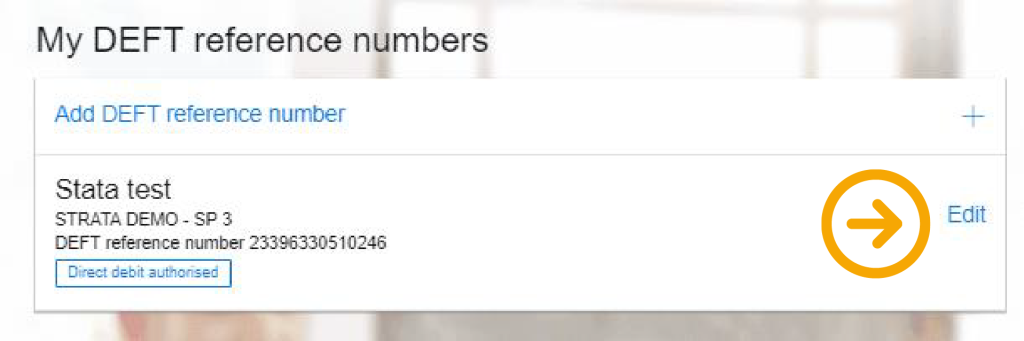

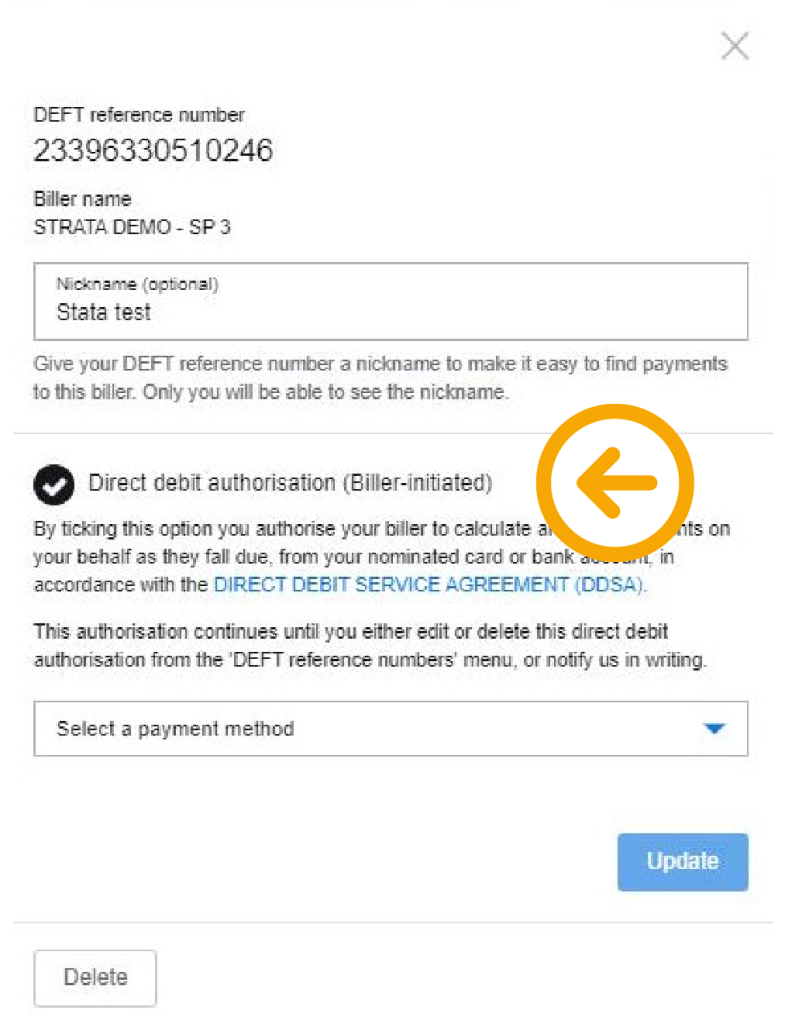

Go to 'DEFT reference numbers', select the DEFT reference number for the property that you wish to authorise direct debits for and click 'Edit'.

Tick' Direct debit authorisation (Biller-initiated)', select a payment method, and click 'Update' to finish setting up your biller-initiated direct debit payment.

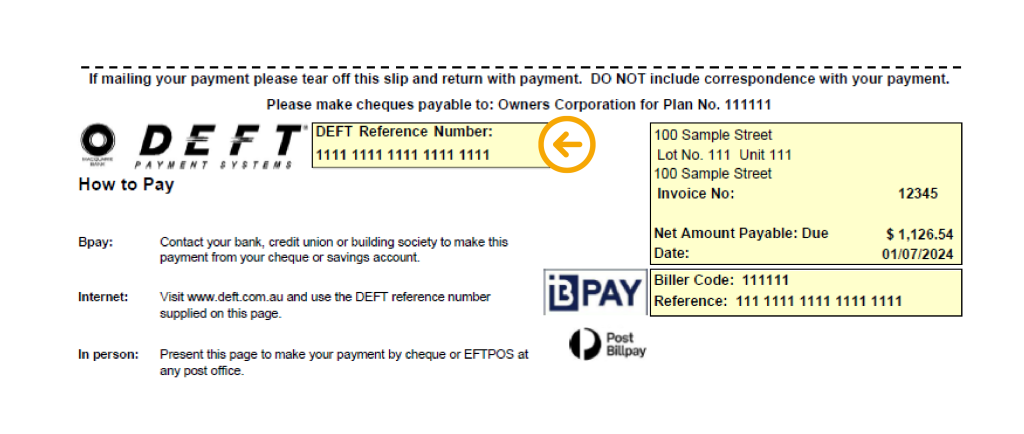

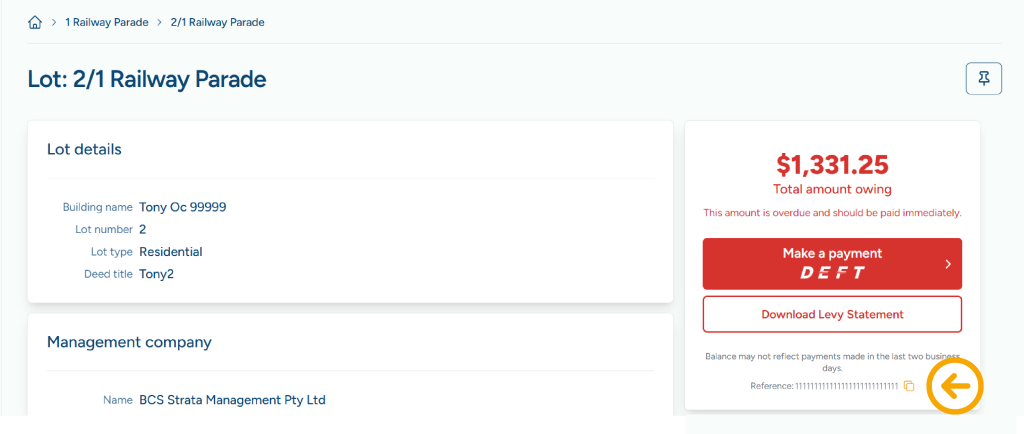

To set up biller-initiated direct debit, you will need your property’s unique DEFT Reference Number. You can find this on your levy notice or the levy payment section in the CommunityHub portal as outlined below.

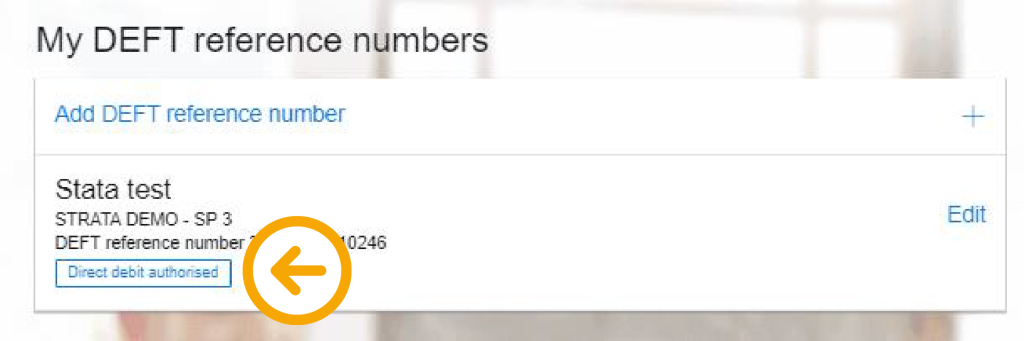

To check if you have direct debits set up correctly, you can follow the below steps:

This means that the direct debit is now active. You can update this anytime by clicking ‘Edit’ next to the DEFT reference number. You can also cancel this arrangement by clicking on ‘Edit’ and then unchecking the black tick to remove biller-initiated direct debit.

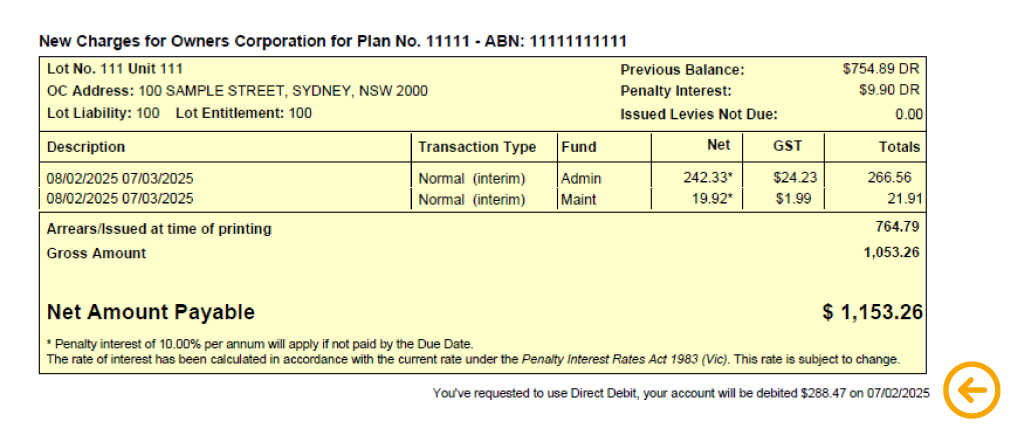

biller-initiated direct debits will apply to the next levy due after you’ve successfully registered this payment method through DEFT as highlighted below.

This means that If you register for a biller-initiated direct debit arrangement before 30 June 2025, the payment will be taken for the next levy due after 1 July 2025.

Please note: biller-initiated direct debit cannot be used to facilitate arrears or payment plan arrangements. Payment must be for the due levy amount in full.

Once you’ve set up biller-initiated direct debit on DEFT, you can cancel this arrangement anytime by following the below steps:

Once you’ve set up a biller-initiated direct debit on DEFT, you can update the payment method on this arrangement anytime by following the below steps:

For more information on how to set up DEFT payment methods, you can visit the DEFT FAQ website here or view the DEFT guide for payers here.

Alternatively, you can also contact DEFT on 1800 672 162 for further assistance with troubleshooting issues on your DEFT accounts.

If you encounter any issues accessing or opening links, please visit the official deft.com.au websites below:

Disclaimer: This webpage is created by PICA Services Pty Ltd ABN 70 651 941 114 (PICA Group), a member of the PICA Group of companies. Links to third-party websites are provided for convenience only, PICA Group does not endorse or accept any responsibility for these websites’ content use or availability. While PICA Group has taken every reasonable care in compiling the information in this letter, we do not guarantee the accuracy or completeness of the information provided. PICA Group accepts no liability for any loss or damage caused by the use of or reliance on the information contained in this letter or any links or third-party websites. You can contact us by calling 1300 889 227 or web chat through our website between 8.30 am and 5.00 pm. Or complete the form on our website anytime, and we will respond during business hours. ©PICA Group 2024.